Frozen Yogurt Market Set to Reach USD 11.53 Billion by 2035, Driven by Health Trends and Flavor Innovation

According to Towards FnB, the global frozen yogurt market size is evaluated at USD 6.60 billion in 2026 and is projected to expand USD 11.53 billion by 2035, reflecting at a CAGR of 6.4% from 2026 to 2035. This growth is fueled by the rising consumer demand for healthier dessert alternatives, as more people opt for low-fat, low-sugar, and plant-based options in their diets.

Ottawa, Dec. 22, 2025 (GLOBE NEWSWIRE) -- The global frozen yogurt market size stood at USD 6.20 billion in 2025 and is predicted to increase from USD 6.60 billion in 2026 to reach around USD 11.53 billion by 2035, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is expected to grow significantly due to factors such as higher demand for healthier snacking options, the growth of the dairy market, increased demand for flavor innovation, and the expansion of frozen yogurt outlets. Flavor innovation, along with balanced nutrition, is another major factor driving market growth.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5961

Key Highlights of Frozen Yogurt Market

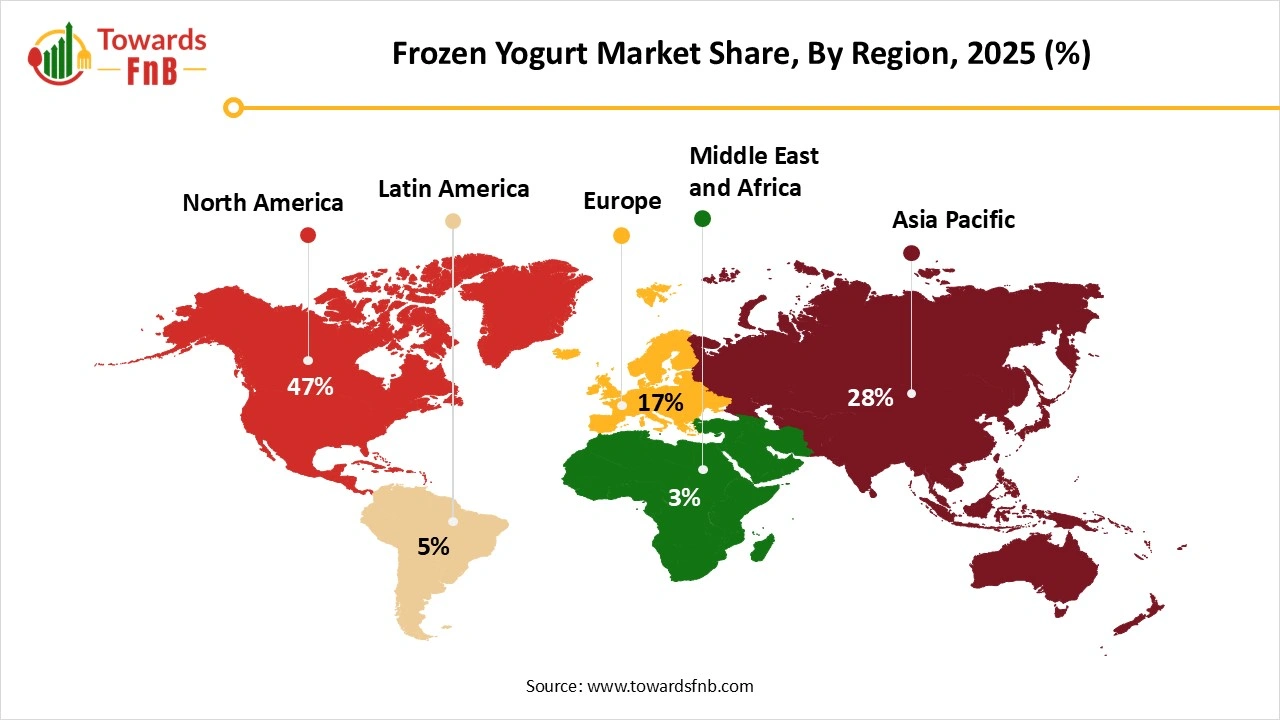

- By region, North America led the frozen yogurt market with largest share of 47% in 2025, whereas the Asia Pacific is expected to grow in the forecast period.

- By flavor, the chocolate segment led the frozen yogurt market in 2025, whereas the strawberry segment is observed to be the fastest-growing in the expected timeframe.

- By fat content, the low-fat segment led the frozen yogurt market in 2025, whereas the no-fat segment is expected to grow in the foreseeable period.

- By distribution channel, the specialty stores segment led the frozen yogurt market in 2025, whereas the online stores segment is expected to grow in the foreseeable period.

The rise of non-dairy and plant-based frozen yogurt is one of the most exciting shifts in the dessert market. As more consumers adopt vegan and lactose-free diets, we are seeing a surge in demand for plant-based frozen yogurt options made from coconut, almond, and oat milk. This trend not only caters to specific dietary needs but also aligns with growing consumer concerns over sustainability and environmental impact, said Vidyesh Swar, Principal Consultant at Towards FnB

New Trends of Frozen Yogurt Market

- Higher demand for healthier, organic, functional, and low-calorie options helps to fuel the growth of the market.

- Higher demand for plant-based frozen yogurt options made from coconut milk, almond milk, and oat milk also helps to fuel the market's growth.

- Flavor innovation and frozen yogurt customization are other major factors for the growth of the market.

Higher Demand for Healthier Snacking is Helpful for the Growth of the Frozen Yogurt Industry

The frozen yogurt market is expected to grow due to higher demand for healthier snack options, plant-based and dairy options, and low-calorie options. Frozen yogurt is a dairy item formulated from fermented milk using bacteria like Lactobacillus bulgaricus and Streptococcus thermophilus. It is also available in plant-based options such as frozen yogurt made from almond milk and soymilk.

The growing population of health-conscious consumers leading to higher demand for healthier snacking options, low-calorie, sugar-free, low-sugar, organic, functional, and all the synonyms for healthy options, is a major factor for the growth of the market. Such options allow consumers to enjoy their snacking time without guilt about consuming unhealthy snacks, while maintaining their calorie count. Hence, such factors help fuel the market's growth over the forecast period. Frozen yogurt with functional benefits, such as calcium, potassium, and protein enrichment, also helps fuel the market’s growth.

Technological Innovations are Helpful to Propel the Growth of the Frozen Yogurt Market

Technological advancements play a crucial role in the growth of the frozen yogurt industry by enhancing product quality and production efficiency. Technological features such as automated freezing and packaging lines and real-time quality control systems have helped reduce operational costs and minimize waste, further fueling the market's growth. AI helps shop owners get creative with their marketing strategies to enhance consumer engagement, further fueling market growth. Hence, technological advancements play a crucial role in the market's growth.

Impact of AI in the frozen yogurt market

Artificial intelligence (AI) is influencing the frozen yogurt market by improving formulation accuracy, strengthening process control, and enabling better alignment with health focused and indulgence driven consumer demand. In product development, AI systems analyze dairy and non dairy bases, live culture stability, sugar alternatives, and fat composition to help manufacturers balance creaminess, tartness, and sweetness. These models evaluate how probiotics, stabilizers, and flavor inclusions behave during freezing and storage, which is critical for maintaining smooth texture and viable cultures over shelf life. This allows producers to develop low sugar, high protein, lactose free, and plant based frozen yogurt variants with more predictable sensory outcomes.

In production, AI driven monitoring systems track overrun, freezing rate, viscosity, and ice crystal formation in real time. Machine learning models adjust churning speed and temperature profiles to prevent graininess and texture collapse, especially in reduced fat or clean label formulations. Computer vision systems inspect product consistency, swirl distribution, and packaging integrity, supporting uniform quality across batches.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/frozen-yogurt-market

Recent Developments in Frozen Yogurt Market

- In April 2025, Lactalis Canada and Nestlé Canada announced their collaboration, marking Lactalis Canada’s entry into the frozen Yogurt category through a new licensing agreement. The new launch will feature eight iOGO-branded frozen Yogurt SKUs, including four bars in strawberry cheesecake, raspberry-chocolate, cherry swirl, and blueberry swirl flavors, and four tubs in vanilla, strawberry swirl, cherry swirl, and blueberry swirl flavors.

- In April 2025, 16 Handles launched their Dubai chocolate frozen Yogurt with all the hyped and viral flavors of the Middle East, along with the flair of the Big Apple.

Frozen Yogurt Market Dynamics

What Are the Growth Drivers of the Frozen Yogurt Market?

The growing health and wellness trends, leading to higher demand for healthier snacking options, are a major driver of market growth. The availability of frozen yogurt in different forms, such as dairy-free options in plant-based milk yogurts, is another major factor driving market growth. Such options are highly preferable to vegans and followers of plant-based diets, fueling market growth. The availability of frozen yogurt in sugar-free and fat-free options, as well as multiple flavors, also helps propel the market's growth. A growing number of frozen yogurt outlets offering customized topping options also helps fuel the market's growth.

Rise of Competitors Hampering the Growth of the Market

The availability of multiple healthier snacking options impedes the growth of the frozen yogurt market. Options such as smoothie bowls, protein bowls, sorbets, protein ice creams, and plant-based options are major competitors that are restricting the market’s growth. The availability of traditional ice creams, gelato, and other palatable options also hinders the market’s growth. Hence, such factors may collectively hamper the market's growth.

Product Innovation Is Helpful for the Growth of the Frozen Yogurt Market

The availability of different types of frozen yogurt, such as plant-based options made from coconut milk, almond milk, or soy milk, flavored options, and high-protein options, helps fuel market growth. The availability of functional and organic yogurt options enriched with protein, calcium, vitamins, and other essential nutrients is helping to fuel the market’s growth. The availability of such an option in retail stores and online platforms also helps fuel the market’s growth.

Product Survey of the Frozen Yogurt Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or Consumer Segments | Representative Brands or Producers |

| Regular Frozen Yogurt | Traditional frozen Yogurt made with cultured dairy Yogurt offering a balance of tartness and sweetness. | Plain frozen Yogurt, vanilla frozen Yogurt | Mass retail, foodservice dessert menus | Yasso, Menchie’s, TCBY |

| Low Fat Frozen Yogurt | Reduced fat formulations positioned as lighter dessert alternatives. | Low fat vanilla, low fat fruit flavors | Calorie conscious consumers | TCBY, store brand frozen Yogurt |

| Non Fat Frozen Yogurt | Fat free frozen Yogurt with higher protein perception. | Non fat plain, non fat strawberry | Diet focused consumers, fitness oriented buyers | Yasso, private label |

| Greek Style Frozen Yogurt | Frozen Yogurt made using strained Yogurt bases for higher protein and creamier texture. | Greek vanilla, Greek honey | Protein focused and premium dessert consumers | Yasso Greek Frozen Yogurt |

| Soft Serve Frozen Yogurt | Dispensed frozen Yogurt served fresh from machines. | Plain tart, fruit swirl soft serve | Frozen Yogurt chains, QSR dessert counters | Menchie’s, Pinkberry |

| Hard Pack Frozen Yogurt | Scoopable frozen Yogurt sold in tubs similar to ice cream. | Pint packs, family packs | Retail freezers, take home desserts | Yasso, Breyers Frozen Dairy Desserts |

| Probiotic Frozen Yogurt | Frozen Yogurt containing live and active cultures for digestive health positioning. | Lactobacillus enriched frozen Yogurt | Health oriented consumers | Pinkberry Original, probiotic focused brands |

| Sugar Reduced Frozen Yogurt | Formulations with reduced added sugar or alternative sweeteners. | Stevia sweetened, erythritol blends | Low sugar and diabetic friendly consumers | Yasso Reduced Sugar Line |

| Plant Based Frozen Yogurt | Dairy free frozen Yogurt alternatives made from plant bases. | Almond milk frozen Yogurt, coconut milk frozen Yogurt, oat based frozen Yogurt | Vegan and lactose intolerant consumers | So Delicious Dairy Free, Silk |

| Organic Frozen Yogurt | Frozen Yogurt produced using certified organic dairy ingredients. | Organic vanilla, organic fruit blends | Organic food shoppers | Stonyfield Organic Frozen Yogurt |

| Fruit Based Frozen Yogurt | Frozen Yogurt blended with fruit purées or pieces. | Mango frozen Yogurt, berry frozen Yogurt | Kids and family dessert consumption | Menchie’s fruit lines |

| Functional Frozen Yogurt | Products fortified with added protein, fiber, or vitamins. | High protein frozen Yogurt, fiber fortified variants | Functional dessert consumers | Yasso Protein Frozen Yogurt |

| Frozen Yogurt Bars and Novelties | Frozen Yogurt molded into bars or coated novelties. | Chocolate coated bars, stick novelties | On the go snacking, kids desserts | Yasso Bars |

| Frozen Yogurt Mixes for Foodservice | Concentrated liquid or powder mixes used by foodservice operators. | Liquid soft serve mix, powdered mix | Frozen Yogurt shops, cafés | Foodservice ingredient suppliers |

| Regional Flavor Frozen Yogurt | Products incorporating region specific or ethnic flavors. | Matcha, pistachio, mango chili | Urban and premium markets | Boutique frozen Yogurt brands |

| Seasonal and Limited Edition Frozen Yogurt | Time limited flavors used for consumer engagement. | Pumpkin spice, summer berry blends | Seasonal retail and foodservice | Chain and private label brands |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5961

Frozen Yogurt Market Regional Analysis

North America Dominated the Frozen Yogurt Market in 2025

North America led the frozen yogurt market in 2025, due to higher demand for organic and functional snacking options in the region. Hence, functional frozen Yogurt enriched with essential minerals, vitamins, and protein helps to fuel the market’s growth in the region. The US has a major contribution to the region's market growth due to higher demand for palatable, customizable, and low-fat options. The growing population of health-conscious consumers in the region, leading to higher demand for healthier snacking options, is another major factor driving market growth.

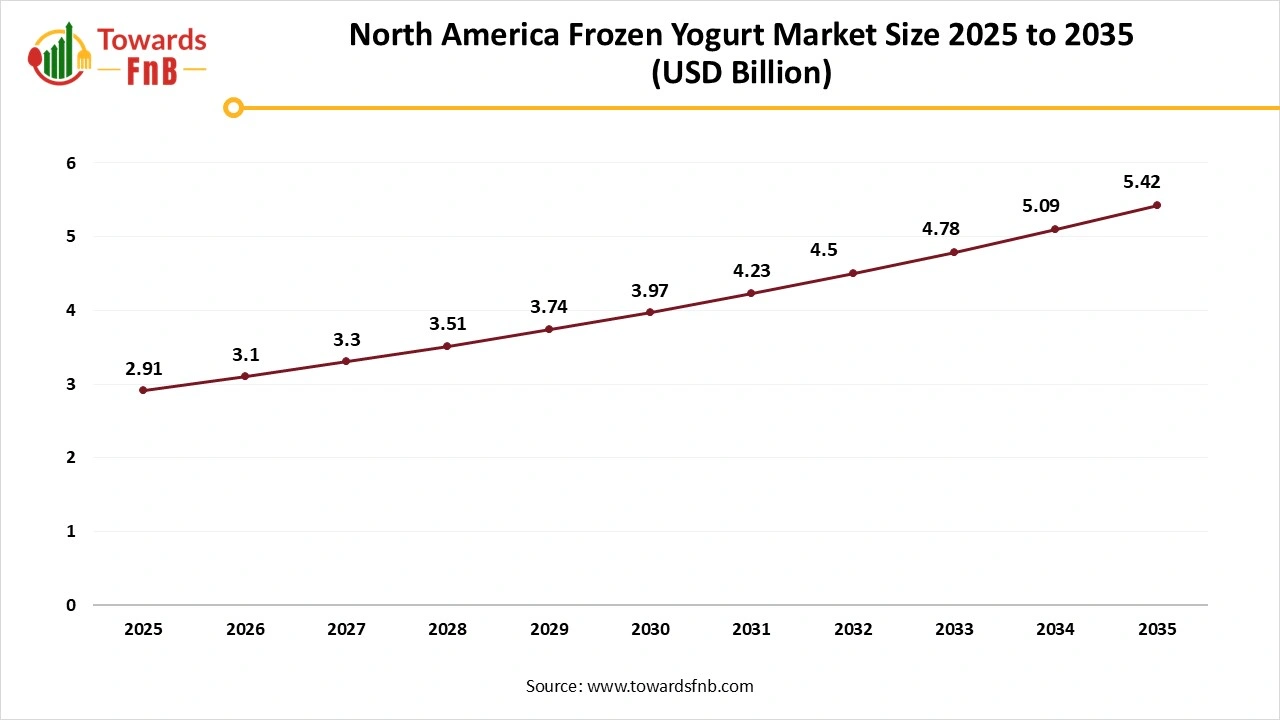

How Big is the North America Frozen Yogurt Market?

The North America frozen yogurt market size reached USD 2.91 billion in 2025 and is predicted to grow from USD 3.1 billion in 2026 to nearly reaching USD 5.42 billion by 2035, growing at a CAGR of 6.4% during the forecast period from 2026 to 2035.

Asia Pacific Is Observed to be the Fastest-Growing Region in the Foreseen Period

Asia Pacific is expected to be the fastest-growing region over the forecast period due to the growing population of health-conscious consumers, leading to higher demand for protein-packed, healthier snacking options. The region also sees growth due to the availability of a wide range of frozen yogurt options on various platforms, allowing one to purchase them easily and avoid junk snacks. India has made a major contribution to the region's market growth due to higher consumer demand for healthier options, rising disposable income, and growing health and wellness trends.

Europe is observed to have a Notable Growth in the Foreseen Period

Europe is expected to show notable growth over the forecast period due to higher demand for probiotics and healthier options. The growing population of health-conscious consumers in the region, leading to higher demand for healthier, functional, and organic options, also helps to aid the market’s growth. The UK has a major contribution to the market's growth, driven by higher demand for healthier snacking and probiotic options.

Trade Analysis for the Frozen Yogurt Market

What Is Actually Traded (Product Forms and HS Proxies)

- Finished frozen Yogurt products in retail or foodservice packs, commonly declared under HS 2105 for ice cream and other edible ice.

- Bulk frozen Yogurt mixes supplied in liquid or frozen form to franchise operators and foodservice chains, typically cleared under HS 2105.

- Powdered Yogurt bases and stabiliser systems used to prepare frozen Yogurt on site, often classified under HS 2106 as food preparations.

- Live Yogurt cultures and starter cultures supplied separately, usually traded under HS 3002 or related biological-product headings depending on national classification.

Top Exporters (Supply Hubs)

- United States: Major exporter of frozen Yogurt mixes, powdered bases and franchise-oriented formulations supported by large dairy processing and foodservice brands.

- Italy: Exporter of frozen dessert bases and stabiliser systems, including Yogurt-based formulations for gelato and frozen Yogurt applications.

- France: Supplier of Yogurt cultures, dairy bases and premium frozen dessert ingredients supported by strong fermented-dairy expertise.

- New Zealand: Exporter of dairy ingredients used in frozen Yogurt mixes, leveraging export-grade milk and dairy powders.

Top Importers (Demand Centres)

- China: High-growth importer of frozen Yogurt bases and mixes driven by expansion of modern retail and urban dessert chains.

- Middle East: Countries such as Saudi Arabia and the United Arab Emirates import frozen Yogurt mixes for franchised foodservice outlets in malls and tourism hubs. (Source: national trade statistics)

- European Union: Intra-EU trade supports frozen Yogurt distribution in foodservice and retail, especially in Germany, France and Spain.

- Southeast Asia: Import demand from Singapore, Thailand and Malaysia linked to café culture and quick-service restaurant growth.

Typical Trade Flows and Logistics Patterns

- Frozen Yogurt mixes and finished products move under frozen or chilled conditions via containerised sea freight or regional road transport.

- Powdered bases and stabiliser blends are shipped as shelf-stable products, reducing cold-chain dependence and supporting longer-distance trade.

- Franchise models often involve centralised sourcing of mixes and cultures from approved suppliers, creating repeated cross-border shipments.

- Cold-chain integrity is critical for finished products, while culture shipments may require temperature control to preserve viability.

Trade Drivers and Structural Factors

- Foodservice franchising: Expansion of branded frozen Yogurt chains drives demand for standardised mixes and bases.

- Health positioning: Lower-fat content and probiotic associations support frozen Yogurt versus traditional ice cream in some markets.

- Urbanisation and tourism: Concentration of demand in malls, airports and leisure destinations shapes import patterns.

- Ingredient innovation: Use of plant-based bases and sugar-reduction systems influences sourcing of stabilisers and cultures.

-

Cold-chain capability: Market access depends on reliable frozen logistics and retail freezer penetration.

Regulatory, Quality and Market-Access Considerations

- Frozen Yogurt products must comply with dairy or non-dairy frozen dessert regulations, including microbiological standards and compositional definitions.

- Live-culture claims may be regulated differently across markets, affecting labelling and import approval.

- Import documentation typically includes certificates of analysis, ingredient specifications, allergen declarations and cold-chain records.

- Plant-based frozen Yogurt variants may face additional ingredient-approval or novel-food scrutiny.

Government Initiatives and Public-Policy Influences

- Dairy-support and milk-price stabilisation policies in exporting countries influence ingredient costs for frozen Yogurt mixes.

- Foodservice and tourism recovery policies indirectly support demand for frozen desserts in key urban markets.

- Nutrition-labelling reforms affect sugar, fat and probiotic claims on frozen Yogurt products.

Frozen Yogurt Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 6.4% |

| Market Size in 2026 | USD 6.60 Billion |

| Market Size in 2027 | USD 7.02 Billion |

| Market Size by 2035 | USD 11.53 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Frozen Yogurt Market Segmental Analysis

Flavor Analysis

The chocolate segment dominated the frozen yogurt market in 2025, driven by high demand among adult and child consumers. The high demand for chocolate flavor and its different varieties also helps to fuel the market’s growth. The availability of different chocolate flavors helps fuel the market’s growth. Incorporation of dark chocolate-flavored swirls and various other options also helps to fuel the market’s growth.

The strawberry segment is expected to grow over the forecast period, as the flavor is nostalgic and highly preferred by consumers across all age groups. The market also sees growth, as the sweet-and-tangy flavor profile of strawberries makes it highly palatable, further fueling the market. The availability of palatable options, along with nutrition, is another major factor driving the market's growth.

Fat Content Analysis

The low-fat segment led the frozen yogurt market in 2025, driven by a growing population of health-conscious consumers and health and wellness trends across different age groups. The market also shows growth, as it is today filled with palatable, nutritious frozen yogurt options across various platforms, allowing consumers to buy them with ease. It helps them buy a variety of products to avoid unhealthy snacking options, which benefits market growth.

The no-fat segment is expected to grow during the forecast period due to health and wellness trends, which are helping to fuel the market’s growth. The growing trend of mindful eating, which allows consumers to make healthier food choices, further fuels the market’s growth in the foreseeable period. Higher demand for no-fat options by health-conscious consumers also helps to fuel the market’s growth.

Distribution Channel Analysis

The specialty stores segment led the frozen yogurt market in 2025, due to the easy availability of such stores near residential areas, which helps consumers shop for their desired options. Such stores have different types of frozen yogurt options in different sections, making it easy for consumers to shop for the right option. Such stores also have DIY counters that help customers serve themselves with different types of Yogurt and flavor options, further fueling the market's growth.

The online sales channel segment is expected to grow over the foreseeable period due to the platform's convenience. The online platform segment has a broad product portfolio, including newly launched products, innovation options, a health and wellness section, and other similar offerings. Hence, the segment will make a major contribution to market growth in the foreseeable period. Online platforms also offer multiple discounts and schemes to make shopping more affordable, further fueling market growth.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Dietary Supplements Market: The dietary supplements market size is projected to reach USD 464.58 billion by 2034, growing from USD 192.68 billion in 2025, at a CAGR of 9.2% from 2025 to 2034.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 214.32 billion in 2025 to reach around USD 347.01 billion by 2034, at a CAGR of 5.5% over the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size is evaluated at USD 22.38 billion in 2025 and is expected to reach USD 55.88 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Sugar-Free Food Market: The global sugar-free food market size is expected to grow from USD 48.14 billion in 2025 to USD 83.2 billion by 2034, growing at a CAGR of 6.27% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Ethnic Food Market: The global ethnic food market size is forecasted to expand from USD 93.47 billion in 2025 to reach around USD 179.21 billion by 2034, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

- Meal Kits Market: The global meal kits market size is projected to rise from USD 17.11 billion in 2025 to approximately USD 58.8 billion by 2034, registering a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Baking Ingredients Market: The global baking ingredients market size is projected to grow from USD 18 billion in 2025 to around USD 31.72 billion by 2034, at a CAGR of 6.5% during the forecast period from 2025 to 2034.

- Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Frozen Yogurt Market

- Yogurtland Inc. (California, U.S.): Yogurtland is a leading frozen yogurt brand known for its self-serve concept and wide variety of customizable options. Their focus on innovative flavors and health-conscious offerings, such as low-fat and non-dairy varieties, allows them to cater to a broad consumer base. This strategic approach strengthens their market presence in North America and drives customer loyalty.

- Gujarat Cooperative Milk Marketing Federation (Gujarat, India): GCMMF, known for its Amul brand, is a major player in India’s dairy market, including frozen yogurt. Their strategy focuses on leveraging strong distribution networks and affordable pricing, making frozen yogurt more accessible in emerging markets. Their ability to provide locally tailored flavors strengthens their competitive edge in the growing Indian market.

- Nestlé S.A. (Vevey, Switzerland): Nestlé is a global food and beverage leader, expanding its frozen yogurt offerings through established brands like Haagen-Dazs. Their strategic focus on premium, functional, and plant-based frozen yogurt variants enhances their appeal to health-conscious and environmentally-aware consumers. This approach supports their global reach and allows Nestlé to capitalize on trending consumer preferences for healthier indulgences.

- General Mills (Minnesota, U.S.): General Mills, with brands like Yasso, has capitalized on the increasing demand for high-protein frozen yogurt. Their strategy focuses on creating innovative, healthier frozen yogurt options that appeal to fitness-focused consumers. By prioritizing product differentiation and direct-to-consumer channels, General Mills strengthens its foothold in the competitive frozen yogurt market.

Segments Covered in the Report

By Flavours

- Chocolate

- Mango

- Banana

- Strawberry

- Pineapple

- Others

By Fat Contents

- Low fat (0.5%-2%)

- No fat (<0.5%)

By Distribution Channel

- Online sales channel (E-commerce)

- Supermarket/Hypermarket

- Specialty Stores

- Retailers (Grocery Stores)

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5961

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Coffee Beans Market: https://www.towardsfnb.com/insights/coffee-beans-market

➡️Soybean Market: https://www.towardsfnb.com/insights/soybean-market

➡️Beef Market: https://www.towardsfnb.com/insights/beef-market

➡️Cheese Market: https://www.towardsfnb.com/insights/cheese-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.