E-Prescription Market Expands to USD 53.17 Billion at 26.84% CAGR by 2034, Driven by Digital Healthcare Adoption

The global e-prescription market size was valued at USD 5.97 billion in 2025 and is predicted to hit around USD 53.17 billion by 2034, rising at a 26.84% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 12, 2026 (GLOBE NEWSWIRE) -- The global e-prescription market size is calculated at USD 7.61 billion in 2026 and is expected to reach around USD 53.17 billion by 2034, growing at a CAGR of 26.84% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5582

Key Takeaways

- North America accounted for the largest share of the market in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR during 2025-2034.

- By product, the solutions segment registered dominance in the market in 2024.

- By product, the services segment is expected to witness rapid expansion in the coming years.

- By delivery mode, the web/cloud-based segment was dominant in the e-prescription market in 2024.

- By delivery mode, the on-premise segment is anticipated to grow at a rapid CAGR in the studied years.

- By end-use, the hospitals segment captured a major revenue share of the market in 2024.

- By end-use, the pharmacy segment is expected to register the fastest growth during 2025-2034.

- By usage methods, the handheld segment dominated the market in 2024.

- By usage methods, the computer-based devices segment is expected to grow significantly in the predicted timeframe.

- By substances, the controlled substances segment led the e-prescription market in 2024.

- By substances, the non-controlled substances segment is expected to be the fastest-growing during the forecast period.

- By specialties, the sports medicine segment was dominant in the market in 2024.

- By specialties, the cardiology segment is expected to witness rapid expansion during 2025-2034.

What are the Revolutionary Growth Factors of E-Prescription?

Primarily, the e-prescription market covers a digital version of a paper prescription, which enables doctors to electronically share therapeutic orders directly to a pharmacy, with minimal errors and enhanced safety. However, the market has several substantial growth factors in its progression, such as emerging cloud-based solutions for scalability, integration with pharmacy systems, telehealth expansion, and initiatives to restrict controlled substance abuse. Recently, Oracle Health unveiled a novel cloud-based eRx system as part of integrated EHR platforms to ensure continuity of care and streamline workflows.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What are the Key Drivers in the E-Prescription Market?

One of the prominent drivers is a rise in government programs and policies that support or mandate digital prescribing to boost healthcare quality and lower errors, like the HITECH Act and Medicare Part D. Additionally, these e-prescribing approaches are crucially reducing medication errors and adverse drug events (ADEs) by facilitating real-time drug interaction checks, allergy alerts, and precise patient history. It is also fueled by the increasing emphasis on paperless prescriptions, automated refills, and easy access to patient data, which ultimately accelerates provider workflow and patient convenience.

What are the Significant Trends in the E-Prescription Market?

- In December 2025, OptimizeRx Corp. entered into four new partner agreements for substantial expansion of the Company’s in-workflow point-of-care (POC) network, securing its long-term competitive position, and elevating total National Provider Identifier (NPI) reach.

- In November 2025, INBRAIN Neuroelectronics partnered with Microsoft to execute the use of agentic AI led by Microsoft’s cloud and data infrastructure.

- In April 2025, Photon Health collaborated with Amazon Pharmacy to unite Amazon Pharmacy’s real-time inventory availability and the Photon patient experience platform.

What is a Vital Limitation in the E-Prescription Market?

The need for huge initial expenditures on software, hardware, training, and ongoing maintenance, mainly for smaller practices, is creating a prominent barrier to the overall market growth. Certain complex, poorly designed software (UI/UX), a shortage of physician/staff training, and issues for less tech-savvy users, specifically for ageing people, which also impacts the global developments in e-prescription solutions.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Regional Analysis

What Made North America Dominant in the Market in 2024?

In 2024, North America held the biggest revenue share of the e-prescription market, due to the immersive policies, including the HITECH Act and Meaningful Use encouragement, which foster the adoption of EHR and e-prescribing. Alongside, the US Drug Enforcement Administration (DEA) further lengthened versatilities to enable providers to prescribe controlled substances via telemedicine without first performing an in-person visit. Additionally, the U.S. Department of Health and Human Services introduced a nationwide program to encourage the adoption of EHR-integrated e-prescriptions across community health centers to mitigate prescription fraud and optimize safety.

In the U.S., e-prescribing has become mainstream, with approximately 92 % of healthcare professionals using electronic prescriptions to send orders directly to pharmacies, greatly reducing reliance on paper. U.S. prescribers now route billions of e-prescriptions annually, supported by national health IT policies and broad pharmacy acceptance across all states.

Why did the Asia Pacific Expand Notably in the E-Prescription Market in 2024?

During the prospective period, the Asia Pacific is anticipated to expand at a rapid CAGR. The promotion of digitalization of healthcare systems through diverse eHealth initiatives and national digital health missions, primarily in India, China, Japan, and Australia are evolving a favourable regulatory landscape to assist the adoption of e-prescribing. However, recently, the government published an "Implementation Plan for the Smart Digital Transformation of the Pharmaceutical Industry (2025-2030)" to promote the use of smart digital technologies across the complete pharmaceutical supply chain, like e-prescribing and smart pharmacies.

In China, digital healthcare is expanding rapidly, with e-prescribing systems becoming core parts of modern clinical workflows and integrated into online consultation platforms serving hundreds of millions of users. Market forecasts show e-prescription solutions growing strongly in revenue and adoption alongside rising digital health infrastructure and chronic care needs.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By product analysis

Which Product Dominated the E-Prescription Market in 2024?

The solutions segment accounted for the biggest share of the market in 2024. This mainly encompasses integrated EHR/standalone software, cloud-based platforms, with a raised focus on united AI, escalated interoperability with Electronic Health Records (EHRs), and progression into telehealth and digital therapeutics. Besides this, the market is advancing mobile-first design that features for patients, including automated refill reminders, cost predictions, delivery tracking, and access to their therapeutic history via secure patient portals.

On the other hand, the services segment is estimated to register rapid growth. Its offerings comprise solution platforms, i.e., integrated/standalone, support, execution, training, and network services. Researchers are focusing on ideal exchange of data between various systems, like EHRs, pharmacies, PBMs, etc., to develop a combined view of patient health records. The recent update includes the European Health Data Space (EHDS), which is effective from March 2025, and emphasises enabling cross-border access to digital pharmacy services.

By delivery mode analysis

Which Delivery Mode Led the E-Prescription Market in 2024?

The web/cloud-based segment held a dominant share of the market in 2024. This is conducted on a subscription or pay-as-you-go model, omitting the need for significant initial infrastructure spending and consistent maintenance expenditures connected with on-premise systems. Extensive examples cover Flipkart Health Plus, which implements the use of drones for rapid medicine deliveries, mainly in Tier 2 and Tier 3 cities in India, and leverages AI for demand prediction and route optimization.

Whereas the on-premise segment is predicted to expand rapidly. Specifically, several giant healthcare systems and organizations are handling large volumes of sensitive patient data, which enables this delivery mode to maintain direct control over their IT infrastructure and sensitive data. However, McKesson offers the "Enterprise Rx" software, with its greater adoption by large pharmacy chains. These systems are explored on-premises to handle complex, mission-critical supply chain and prescription workflows.

By end-use analysis

What Made Hospitals Segment Dominant in the Market in 2024?

In the e-prescription market, the hospitals segment registered dominance in 2024. Across the world, Wasfaty of Saudi Arabia, Denmark, Brigham and Women’s Hospitals, UNS hospitals, etc are increasingly adopting e-prescription and other digital healthcare solutions. The advanced platform, like Cerner Pharmacy, is widely employed in the U.S., which is united with Cerner EHR for efficient data management.

Moreover, the pharmacy segment is estimated to witness the fastest growth. With a rise in internet and smartphone usage, doorstep delivery, ease of ordering, and preference for contactless services, this is further fostering demand for e-pharmacies. Recently embedded Surescripts' "Sig IQ" service utilizes AI for the conversion of free-text directions into structured instructions, which further eliminates misinterpretation and adverse events. Alongside, Teladoc Health and Ro have combined their virtual consultation services directly with pharmacy fulfillment systems, which allows patients to have a virtual doctor's visit and receive their same-day prescriptions for pickup or delivery.

Get the latest insights on healthcare industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By usage methods analysis

How did the Handheld Segment Lead the E-Prescription Market in 2024?

In 2024, the handheld segment captured the largest share of the market. This mainly facilitates a comprehensive, accessible record of a patient's medication history, which allows more informed decision-making. The emergence of handwriting-to-digital solutions, such as SmartSync by TatvaPractice, enables doctors to write prescriptions naturally, with perfect conversion into digital records. The globe is encouraging wider adoption of mHealth apps and mobile platforms, which empower the use of handheld devices for e-prescribing, and enables for remote consultations and prescription management during teleconsultations.

However, the computer-based devices segment is predicted to expand at a lucrative CAGR. A substantial advantage is simplifying processes, accelerating prescription fulfillment, and enabling real-time data access for providers. Although mobile devices are offering medication reminders and secure communication channels, while web-/cloud-based solutions are exploring scalability, remote accessibility, and minimal infrastructure spending. The latest breakthrough includes DrFirst's SmartRenew, an AI-assisted solution for automating prescription refill authorizations.

By substances analysis

How did the Controlled Substances Segment Dominate the Market in 2024?

The controlled substances segment dominated with a major revenue share of the e-prescription market in 2024. The segment is specifically impelled by a growing number of instances of prescription drug misuse and fraud, which need better control, with EPCS facilitating a secure, trackable chain of trust from prescriber to pharmacy. Recently, Nebraska initiated a requirement for all controlled substance prescriptions from dentists to be electronic. Whereas, Illinois mandated e-prescribing for prescribers conveying more than 150 controlled substance prescriptions per year.

On the other hand, the non-controlled substances segment is anticipated to grow rapidly. A rise in the prevalence of diabetes, hypertension, and asthma often demands prescriptions, which supports e-prescribing. Fewer strict regulations for non-controlled drugs are making them easier to integrate into e-systems & bolsters the widespread adoption. The market is focusing on booming interoperability through novel data standards, the integration of AI for clinical decision support, and the accelerating adoption of cloud-based and mobile platforms.

By specialties analysis

Why did the Sports Medicine Segment Lead the Market in 2024?

The sports medicine segment registered dominance in the e-prescription market in 2024. Nowadays, athletes are looking for advanced solutions for injury prevention and treatment, like pain meds, muscle relaxants, and rapid recovery, which require digital prescriptions. Based on past injuries, medications, and performance data, from a single interface, e-prescription offers substantial solutions. Recently, an "Exercise Dose SmartPhrase" executed within the Epic EHR system in heart failure clinics is being established and tested to operationalize and document non-pharmacological prescriptions, such as exercise regimens.

Besides this, the cardiology segment will expand rapidly. The escalating CVD cases and the broader application of cardiology information systems are influencing e-prescribing. Whereas AI algorithms are enabling clinicians to prescribe the most efficacious drugs with lower side effects from the outset, & stepping beyond "one-size-fits-all" approaches. AliveCor created AI algorithms that can be used in detecting atrial fibrillation from smartphone ECG recordings, and these insights can be united into the patient's e-prescription plan for faster intervention.

Also Read:

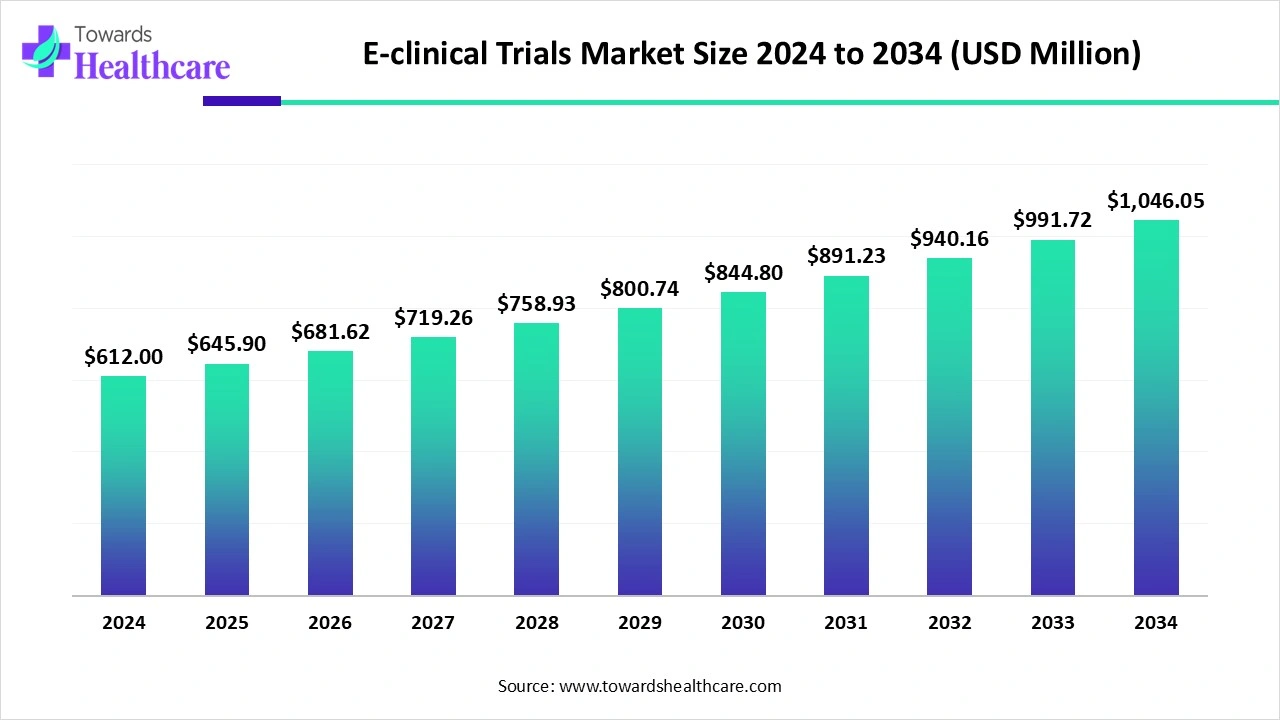

E-Clinical Trials Market Growth

The global e-clinical trials market size is estimated at US$ 612 million in 2024, is projected to grow to US$ 645.9 million in 2025, and is expected to reach around US$ 1046.05 million by 2034. The market is projected to expand at a CAGR of 5.54% between 2025 and 2034.

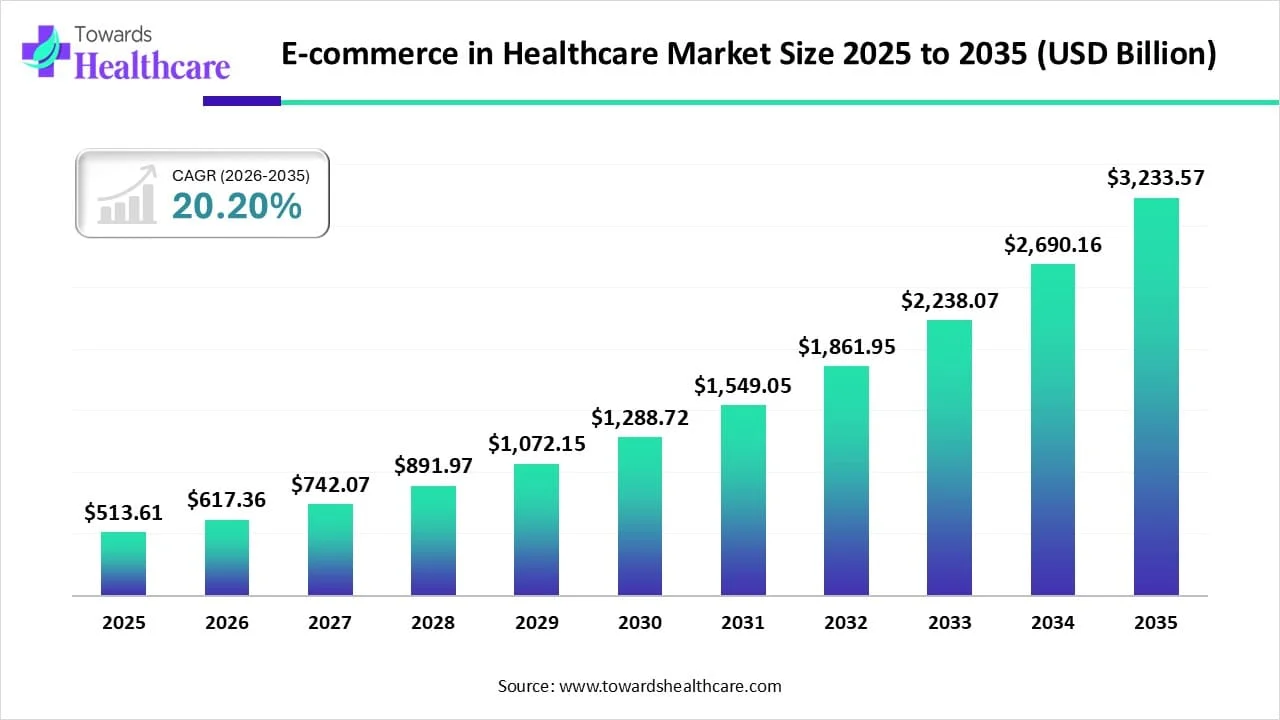

E-commerce in Healthcare Market Growth

The e-commerce in healthcare market size touched US$ 513.61 billion in 2025, with expectations of climbing to US$ 617.36 billion in 2026 and hitting US$ 3233.57 billion by 2035, driven by a CAGR of 20.20% over the forecast period.

E-Pharmacy Market Growth

The global E-pharmacy market size is estimated at US$ 96.94 billion in 2024, is projected to grow to US$ 112.91 billion in 2025, and is expected to reach around US$ 435.82 billion by 2034. The market is projected to expand at a CAGR of 16.44% between 2025 and 2034.

What are the Major Developments in the E-prescription Market?

- In December 2025, Tashkent and several other cities in Uzbekistan launched the DMED “Electronic Prescription” system for dispensing medicine exclusively with a doctor’s prescription.

- In November 2025, Vagaro launched E-Prescribe, an innovative integration developed to advance and streamline how medspas and other providers manage prescriptions.

-

In May 2025, Rajendra Institute of Medical Sciences (Rims) began a trial of e-prescription services in its psychiatry department as a part of its strategy to introduce digital transformation in healthcare.

E-Prescription Market Key Players List

- AdvancedMD

- DoseSpot

- DrFirst

- FredIT

- iCoreConnect, Inc.

- MDToolbox

- PharmacyX

- PracticeSuite

- Practice Fusion

- RXNT

- Surescripts

- Veradigm

Segments Covered in the Report

By Product

- Solutions

- Integrated Solutions

- Standalone Solutions

- Services

- Support

- Implementation

- Training

- Network

By Delivery Mode

- Web/Cloud-based

- On-premise

By End-Use

- Hospital

- Pharmacy

- Office-based Physicians

By Usage Methods

- Handheld

- Computer-based Devices

By Substances

- Controlled Substances

- Non-controlled Substances

By Specialties

- Sports Medicine

- Cardiology

- Oncology

- Neurology

- Others

By Region

- North America

- US

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5582

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.